Not known Details About Best Broker For Forex Trading

Not known Details About Best Broker For Forex Trading

Blog Article

Not known Details About Best Broker For Forex Trading

Table of ContentsBest Broker For Forex Trading Fundamentals ExplainedGetting The Best Broker For Forex Trading To WorkThe Basic Principles Of Best Broker For Forex Trading Getting My Best Broker For Forex Trading To WorkBest Broker For Forex Trading - An Overview

Since Foreign exchange markets have such a big spread and are made use of by a substantial variety of individuals, they supply high liquidity on the other hand with various other markets. The Foreign exchange trading market is constantly running, and many thanks to contemporary innovation, is easily accessible from anywhere. Therefore, liquidity describes the reality that anyone can get or sell with a basic click of a button.Consequently, there is always a prospective merchant waiting to get or market making Foreign exchange a liquid market. Rate volatility is just one of one of the most vital variables that assist pick the following trading move. For temporary Forex investors, cost volatility is critical, given that it portrays the per hour changes in an asset's worth.

For long-term financiers when they trade Foreign exchange, the price volatility of the market is also essential. This is why they consider a "get and hold" technique might provide greater incomes after an extended period. One more considerable benefit of Foreign exchange is hedging that can be used to your trading account. This is a reliable method that helps either eliminate or minimize their danger of losses.

What Does Best Broker For Forex Trading Do?

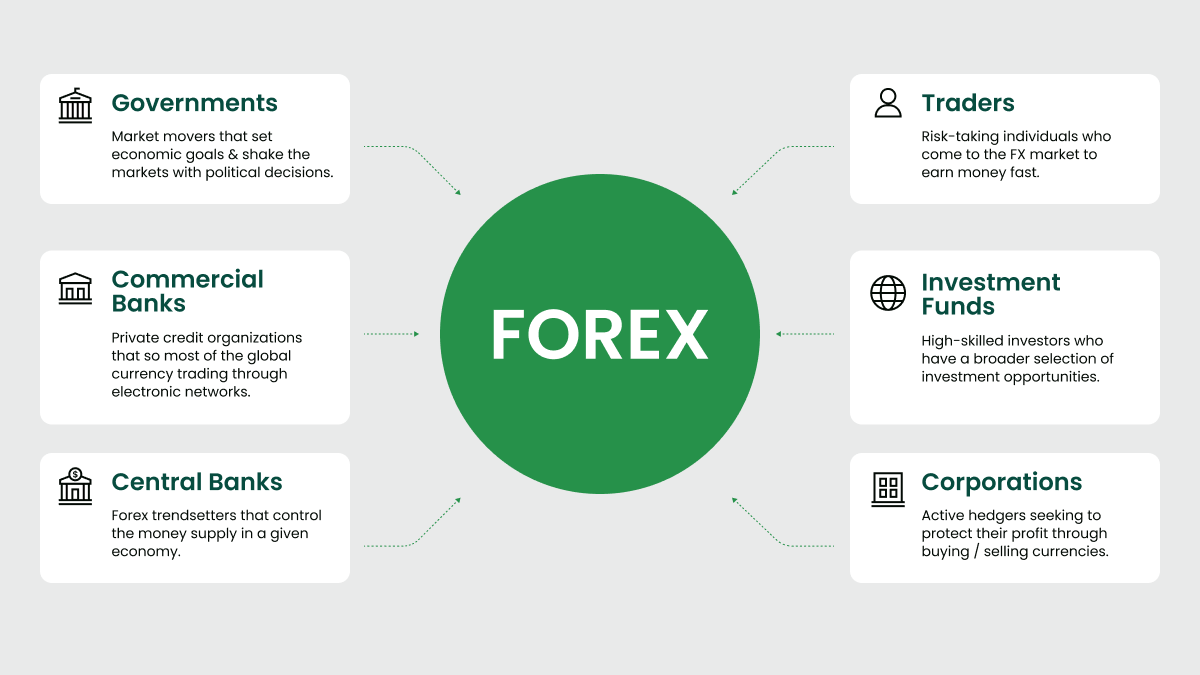

Depending upon the moment and effort, traders can be separated right into classifications according to their trading style. A few of them are the following: Forex trading can be efficiently applied in any one of the methods above. Due to the Foreign exchange market's great quantity and its high liquidity, it's possible to get in or exit the market any kind of time.

Foreign exchange trading is a decentralized technology that operates with no main management. That's why it is a lot more susceptible to fraudulence and various other kinds of perilous tasks such as deceptive assurances, too much high threat levels, etc. Thus, Forex guideline was established to develop a truthful and moral trading attitude. In addition, a foreign Forex broker must follow the standards that are defined by the Forex regulatory authority.

Hence, all the transactions can be made from anywhere, and because it is open 24-hour a day, it can also be done at any kind of time of the day. If an investor is located in Europe, he can trade throughout North America hours and keep track of the moves of the one money he is interested in.

3 Easy Facts About Best Broker For Forex Trading Described

In contrast with the stocks, Forex has really low transaction expenses. This is since brokers earn their returns with "Things in Percent" (pip). Moreover, many Forex brokers can supply an extremely reduced spread and lower or perhaps remove the investor's expenses. Investors that choose the Foreign exchange market can enhance their revenue by staying clear of charges from exchanges, down payments, and other trading activities which have extra retail transaction costs in the securities market.

There is the opportunity that leverage might enlarge traders' losses. It offers the choice to enter the market with a he has a good point little spending plan and trade with high-value currencies. Often, it is taken into consideration an obligation. Some investors might not fulfill the needs of high leverage at the end of the transaction. It's feasible to make a smaller sized initiative and advantage from high revenue potential.

Forex trading might have trading terms to protect the marketplace participants, yet there is the threat that someone might not respect the agreed contract. The Foreign exchange market functions 24 hr without stopping. Traders can not monitor the changes daily, so they utilize formulas to secure their passions and their financial investments. Thus, they require to be frequently notified on exactly how the modern technology works, otherwise they may encounter great losses during the evening or on weekends.

When retail investors refer to price volatility in Forex, they indicate just how big the upswings and drop-offs of a currency set are for a certain period. The bigger those ups and downs are, the greater the price volatility - Best Broker For Forex Trading. Those big modifications can stimulate a sense of unpredictability, and often investors consider them as a possibility for high revenues.

Best Broker For Forex Trading Fundamentals Explained

Some of the most volatile money pairs are considered to be the following: The Foreign exchange market uses a great deal of opportunities to any type of Forex investor. As soon as having determined to trade on forex, both seasoned and newbies require to specify their financial method and obtain knowledgeable about the conditions.

The content of this short article mirrors the author's opinion and does not necessarily reflect the main position of LiteFinance broker. The material published on this page is provided for educational functions just and need to not be considered as the provision of financial investment suggestions for the purposes of Directive 2014/65/EU. According to you can try these out copyright legislation, this short article is thought about intellectual property, that includes a restriction on duplicating and distributing it without authorization.

If your company operates worldwide, it is essential to recognize how the value of the united state buck, about various other money, can dramatically impact the price of products for U.S. importers and exporters.

The Facts About Best Broker For Forex Trading Revealed

In the very early 19th century, money exchange was a significant part of the operations of Alex. Brown & Sons, the initial financial investment financial institution in the USA. The Bretton Woods Arrangement in 1944 needed money to be secured to the United States buck, which remained in turn pegged to the price of gold.

Report this page